A Comprehensive Guide to Growth User Research

How to Conduct Research that Impacts Your Organization's Growth

👋🏻Hi, this is Nikki with a 🔒subscriber-only 🔒 article from User Research Academy. In every article, I cover in-depth topics on how to conduct user research, grow in your career, and fall in love with the craft of user research again.

I remember when one of my stakeholders came to me and asked, “how can user research help support the growth of the company?”

At first, it seemed obvious to me that user research was fully capable of helping a company, but when I went to answer, I wasn’t entirely certain what to say.

While the research I had done greatly helped improve the current experience and understanding our current users, I found this much easier to tie to things like retention rather than growth and acquisition.

When I returned to the stakeholder, instead of saying “yes,” which I so badly wanted to say, I asked him what he meant by growth to understand what he was asking for fully.

With his response and context, I learned about a new type of user research I could conduct — growth user research.

How I Define Growth User Research

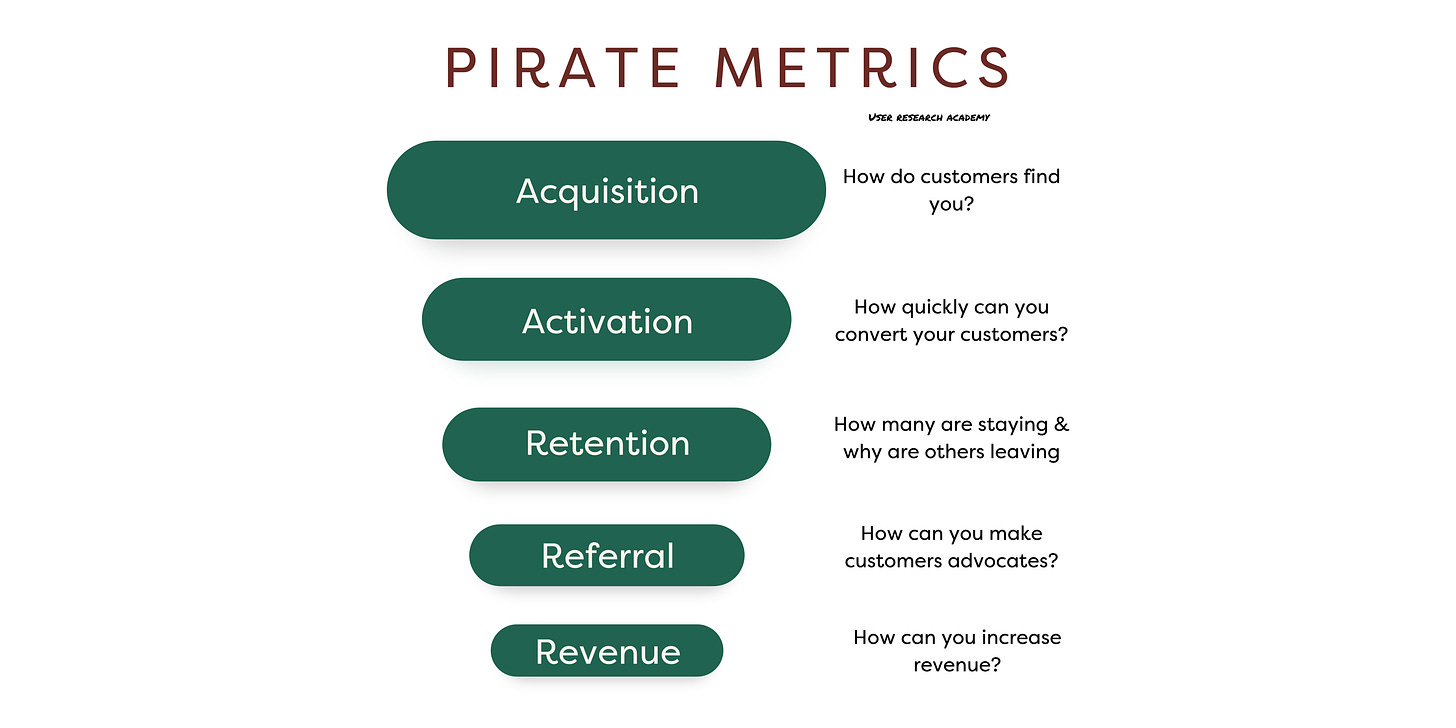

In the past, I have used pirate metrics to help me connect user research to business impact. This model, coined by Dave McClure* in 2007, highlights the five most critical metrics for businesses to track for success.

I’ve found pirate metrics to be incredibly helpful in this because they hit on the entire funnel of getting customers through to revenue, which is extremely applicable to most businesses. They give a very straightforward way to think about really critical parts of a successful business.

When it comes to growth user research and pirate metrics, you focus on the acquisition and activation phases. These phases essentially cover how people come to you and find your product/service and then how you convert those visitors into actual customers. By focusing on acquisition and activation, you can directly impact the company's growth.

The primary goal of growth research is identifying opportunities and barriers for business growth within user interactions and market trends. This type of research not only scrutinizes how existing users interact with an app but also why potential users might choose to download or ignore it. It seeks to understand the user journey from initial awareness to loyal usage, pinpointing specific interventions that can transform casual users into committed ones.

*Dave McClure is not a stunning human, having been accused of sexual harassment. I’m not a fan of him, but I wanted to cite the original source of the pirate metrics. While he sucks, hopefully, we can leverage this model for the greater good.

Why is Growth Research Important?

There are so many products and services out there that aim to solve pain points and help users achieve particular goals. And while I am a huge believer in the fact that there are plenty of users to go around, companies still want to understand how to scale and grow.

And, with all the noise out there with all these products and services, many companies face stagnation in daily active users (DAU) and monthly active users (MAU), as well as potentially high Customer Acquisition Costs (CAC). Experiencing stagnancy in these metrics usually signals problems with growth within acquisition, activation, and market positioning.

Companies with flatlining user growth find it difficult to attract venture capital, sustain revenue generation, and scale, which can lead to companies laying off many employees (which we’ve seen a lot of recently) or completely going under (something else I’ve also seen and experienced). Furthermore, in social and network-based apps, where user value often increases with the size of the user base, stagnant metrics can lead to a downward spiral in user engagement and revenue. And (fortunately or unfortunately), revenue is essential to organizations.

Conducting growth user research can help positively impact these metrics by understanding these key areas of acquisition and activation. Through this approach, you can understand why people are engaging with or ignoring your product/service and why they are (or not!) converting from visitors to actual customers.

Through this type of research, you can impact some of the most important metrics for companies—every company needs to grow and to grow, they need to understand how to get customers. With this information, you can help the company innovate, create more effective user acquisition tactics, enhance activation strategies, and ultimately deliver a product that resonates more deeply with its target audience.

So, how do you conduct this powerful type of user research?

The Fundamentals of Growth User Research

When conducting growth user research, I typically focus on the top two areas of the pirate metrics funnel: acquisition and activation.

Acquisition - how people find and are introduced to your product/service

Acquisition is all about getting new customers into your product/service so that they know it exists as an option to solve one of their pain points or support an unmet need in one of their goals. There are many ways a company can do this, such as:

SEO

Marketing (including email and social media)

Sales

Paid advertising

Acquisition is the top of the funnel. Without properly acquiring users, sustaining a product or service over time is difficult, which is why it is incredibly important to apply user research to this part of the process.

Activation - how people begin to use your product/service

It’s good if people find you, but that first interaction is key. After running my business for almost two years full-time, I know how important it is to activate users and get them to take that first step with you.

There are many ways to activate users, which hugely depends on your product/service/organization. However, when you think about activation, think about the primary conversion metrics that determine the success of certain channels and campaigns rather than high-level or micro-conversions. This could look like a funnel:

Someone comes to your website

They see value in your work

They try a free trial, book a demo, or sign up for a newsletter

Activation is the beginning of your relationship with the customer. Before this, they’re anonymously researching your business and competitors before they take any specific action that allows you to begin directly engaging with them.

For me, these two areas are growth research because they allow you to understand and grow your user base. Of course, retention is extremely important, but you need people to retain before turning to retention, and that is where growth user research comes in.

Goals of Growth User Research

Research goals are the most important part of setting your study up for success, and it is no different when it comes to growth user research. By understanding what you are trying to accomplish from the get-go, you ensure you choose the right methodology to get the exact information your stakeholders need to make whatever decisions they face that need to move forward.

I tend to bucket goals into two different areas:

Business goals, which focus on the goals of the actual business and tend not to be user-focused. This is what the business is hoping for out of the study.

Study goals, which focus on the user and on what information you are trying to understand from participants

I split these goals up because they serve completely separate needs. Typically, from stakeholders, I receive very business-oriented goals. For example, they want to increase the conversion rate of a product or service. The thing is, I can’t go and ask users, “Why didn’t you convert?” Not only is that a hugely leading and biased question, but it is also impossible for someone to answer (try answering it yourself about a product!).

However, these business goals are incredibly important for us to incorporate as user researchers because one of the best ways we can impact an organization is to tie our research project to business-related goals and metrics.

By separating these goals, your study can simultaneously hold a business and user focus, ensuring you are doing the most impactful research for the business and focusing on the users’ needs, goals, and pain points.

Business-Related Goals

When it comes to growth user research, here are some business-related goals you can expect:

Increase App Downloads: Companies can optimize their marketing channels and app store presence by understanding the pathways through which potential users discover apps. For example, if research indicates that most downloads come from social media ads, focusing research on understanding current campaigns could be beneficial.

Increase App Store Ranking: Your app’s position in search results and category rankings influence visibility and download rates. Companies often want to optimize where they fall within this ranking, which is great for social proof.

Increase Conversion Rate: Conversion rate doesn’t always involve money. This can also represent the number of people who take action after visiting a product or service, which indicates a movement from acquisition toward activation.

Decrease Time to Activation: This looks at the average time it takes for a new user to reach the activation point after first engaging with a product or service, which is incredibly important in converting customers from casual to more committed.

Increase Activation Rate: Activation rate looks at the percentage of users who take a specific desired action within the product/service, such as completing a profile setup or making a first booking.

Increase Retention Rates at Day 1, 7, and 30: Retention rates measure the percentage of users who return to the product or service one day, seven days, and thirty days after the initial conversion. I know retention is a separate study, but looking at early retention can still help understand acquisition.

As you can see, these are very business-focused, and nowhere in these goals is the user mentioned in terms of more deeply understanding them. This is why it is so important to include user-focused study goals, so we ensure we aren’t asking people why they haven’t yet activated or converted.

Study-Related Goals

Now that we understand our business counterpart, it is time to look at user-centric growth research study goals that will get us the information to help answer those business goals. Later on in this article, I will highlight the different methods you can use to act on these goals, but let’s first take a look at some examples:

Identify channels that potential users frequent and understand their current experience with our product/service on these channels

Discover pain points during the activation and onboarding process

Uncover the current journey people go through when trying to find a product/service to help them accomplish [x goal]

Learn about unmet needs (both inside and outside our product/service) people are experiencing, from awareness to onboarding

Discover users’ goals when searching for and engaging with similar products/services

Evaluate the current process from awareness to onboarding to locate key problems and confusion

These goals are completely focused on people's experiences and the feelings associated with them. This type of information is critical for answering our business goals. Without understanding the journey people are going through, the friction they experience, and what is missing, we can’t meaningfully impact the business goals.

When we empathize and deeply resonate with our users’ experiences, we can create products/services appropriate to their needs and goals, which will naturally have a positive influence on the organization’s business goals.

Key Metrics to Monitor (aka Success Metrics)

In addition to business goals, I highly recommend looking into growth-related metrics, which I always include in the success metrics section of my research plan.

Ideally, your success criteria should be measurable and related to your business and study goals. A great question is, “What would determine if this research project succeeds?” You can look at this from both a business and user perspective.

Regarding growth user research, it is crucial to compare certain metrics before and after the research is conducted and changes are made. Comparing these metrics before and after the changes helps identify how successful the project was and also helps us demonstrate concrete impact as researchers.

When it comes to these, I recommend measuring the following success metrics (not all might apply to your organization, so pick and choose what makes the most sense):

DAU and MAU: Daily Active Users and Monthly Active Users provide a clear picture of the app’s usage frequency and can indicate user engagement over time.

Download Rate: Total number of downloads over a specific period. This metric helps measure the immediate impact of acquisition efforts.

Cost per Acquisition (CPA): The cost associated with acquiring a new customer, typically calculated by dividing marketing expenses by the number of new users acquired. It’s essential for evaluating the financial efficiency of your acquisition strategies.

Activation Rate: The activation rate looks at the percentage of users who take a specific desired action within the product/service, such as completing a profile setup or making a first booking.

Time to Activation: The average time it takes for a new user to reach the activation point after first engaging with the product. Faster activations can indicate a more intuitive user experience.

User Retention Rates (first visit): Measures the percentage of users who return to the app after their first visit. Low retention rates can indicate problems with app functionality, value proposition, or user experience.

Conversion Rates from Visitor to Registered User: This tracks how many visitors become registered users, which can help identify barriers in the registration process or initial user experience that could be optimized for better conversion.

Bounce Rate: Understanding where people bounce off your product/service is extremely helpful in seeing where there might be problems. With a lower bounce rate, you can assume the content is better resonating with users/customers.

Some of these metrics are directly tied to the business goals, which makes complete sense. Writing these may feel repetitive, but it is always important to ensure we have measurable metrics written somewhere to explore after the research project and changes are made.

Preparing for Growth User Research

Before diving straight into conducting growth user research at your organization, there are some steps to take to ensure the project's success.

Understand the Point of the Project

I know this might seem like a silly point, but my experience has sometimes involved taking a “full steam ahead” approach without thinking more deeply about the project I am trying to complete.

Especially when faced with something new or less familiar, I can forge ahead without being as intentional or thoughtful about what I’m trying to accomplish. This mindset has led me to say yes to projects only to figure out later that I either couldn’t get the data or got data that, ultimately, wasn’t helpful.

Take the time to understand the project's point/ultimate goal and if user research can help. For instance, if your organization wants to know your potential customers' different preferences, user research isn’t suited for that type of project because we can’t practically measure preference.

At this stage, deeply understand your organization’s and stakeholders’ needs for the project and assess if it is the best fit for research or if another department, such as marketing, can better help.

If your stakeholders struggle to articulate their needs, I recommend doing stakeholder interviews or having them fill out an intake document.

Set Research Goals

Once you have identified that user research can help answer your stakeholders' questions, it is time to set research goals immediately. These goals can help you further establish if user research is the best approach for the project because, if you struggle to create goals, it can indicate that user research might not be right to answer stakeholders’ questions and needs.

As mentioned above, goals help you establish what you need to learn from your research project and the most relevant information you need to gather from your participants. Establishing these goals not only sets the focus for your project but also helps tremendously with recruiting the correct participants and forming the best interview questions.

One way to start formulating research goals is to ask yourself (and stakeholders, of course) a few different questions, such as:

What do we want to learn about [research topic]?

What type of experiences do we want to learn about?

What information do we need by the end of the study?

What decisions are we trying to make by the end of the study, and what can help us make those decisions more confidently?

You can also fill out the following prompt:

I need [information] to understand [proposed research goal] to make [decision] that will impact [team/organizational goal]. Then, by the end of the study/workshop, I need [ideal outcome].

By writing down all this information, you can create concrete research goals that ensure you get the exact information you need from your study. As a refresher, here are some potential goals you can use as a jumping-off point:

Identify channels that potential users frequent and understand their current experience with our product/service on these channels

Discover pain points during the activation and onboarding process

Uncover people's current journeys when they are looking for a product or service to help them accomplish [x goal]

Learn about unmet needs (both inside and outside our product/service) people are experiencing, from awareness to onboarding

Discover users’ goals when searching for and engaging with similar products/services

Evaluate the current process from awareness to onboarding to locate key problems and confusion

I recommend having no more than three goals for any study. Going over three goals increases the scope and makes it hard to get in-depth information on each goal.

Identify Your Target Audience

With a clear focus on the information you need, identifying who you need to talk to becomes much easier because you can create screener questions based on the goals you need to accomplish.

When it comes to segmenting your users, there are several ways to do it:

Demographic Segmentation: Break down your audience by age, gender, income, etc., to understand who uses your product or service.

Behavioral Segmentation: Analyze how different users interact with your product. Look at usage patterns, purchase behaviors, and loyalty.

Psychographic Segmentation: Consider the attitudes, goals, and other psychological criteria influencing how different audience subsets engage with your product.

Personally, I am a fan of a combination of all three of these different segmentation types, depending on the product/service. For example, when I was working on understanding how Gen-Z gets fashion inspiration, demographic information was key in understanding age and income. Still, I also had to look at psychographic segmentation, including their goals and attitudes toward fashion.

When I sit down to brainstorm recruitment criteria, I usually bucket them into the above types of segmentation. For example, when I was working with a real estate company trying to understand intent to purchase a new home, we brainstormed the following criteria:

Behavioral data:

Have searched for a house in the past three weeks

Have never bought a home before

The person "in charge" of the home-buying experience

Checking for homes every day

Product usage:

Have used the product in the past month

Have used a competitor's product in the past month

Psychographic data:

Would like to move in the next two months

Are looking for specific criteria in a house (ex: yard, kid-friendly, location)

Demographic data:

Age

Income level

You can then use these criteria to help you form a screener survey. Because your screener questions are based directly on the criteria you need, it will help ensure that you get the best participants for your study—the ones who can give you all the juicy information you need.

Now, with growth user research, it is important to go one step further because you want to ensure you are picking a segment that shows growth potential. For instance, if younger users are more engaged but represent a smaller portion of your base, they might be a key target for your research to understand how to grow that particular segment.

Look into your data to understand the potential for growth from your current user base, and take the time to hone into those segments as well.

Choose the Best Research Methods

Understanding the goals and the participants you need to speak to allows you to choose the best approach to the study intentionally. When it comes to growth user research—or, really, all research studies—I always recommend a mixed methods approach whenever possible and applicable.

With a mix of quantitative and qualitative data, you give your team a holistic picture of users and the experience, armoring them with all the data they need to make the best decisions moving forward. I know incorporating mixed methods isn’t always possible, so don't worry too much if you can't. However, if you can, I recommend trying it.

Below are some potential methods you can use in growth user research.

Potential Quantitative Methods:

Keep reading with a 7-day free trial

Subscribe to The User Research Strategist to keep reading this post and get 7 days of free access to the full post archives.